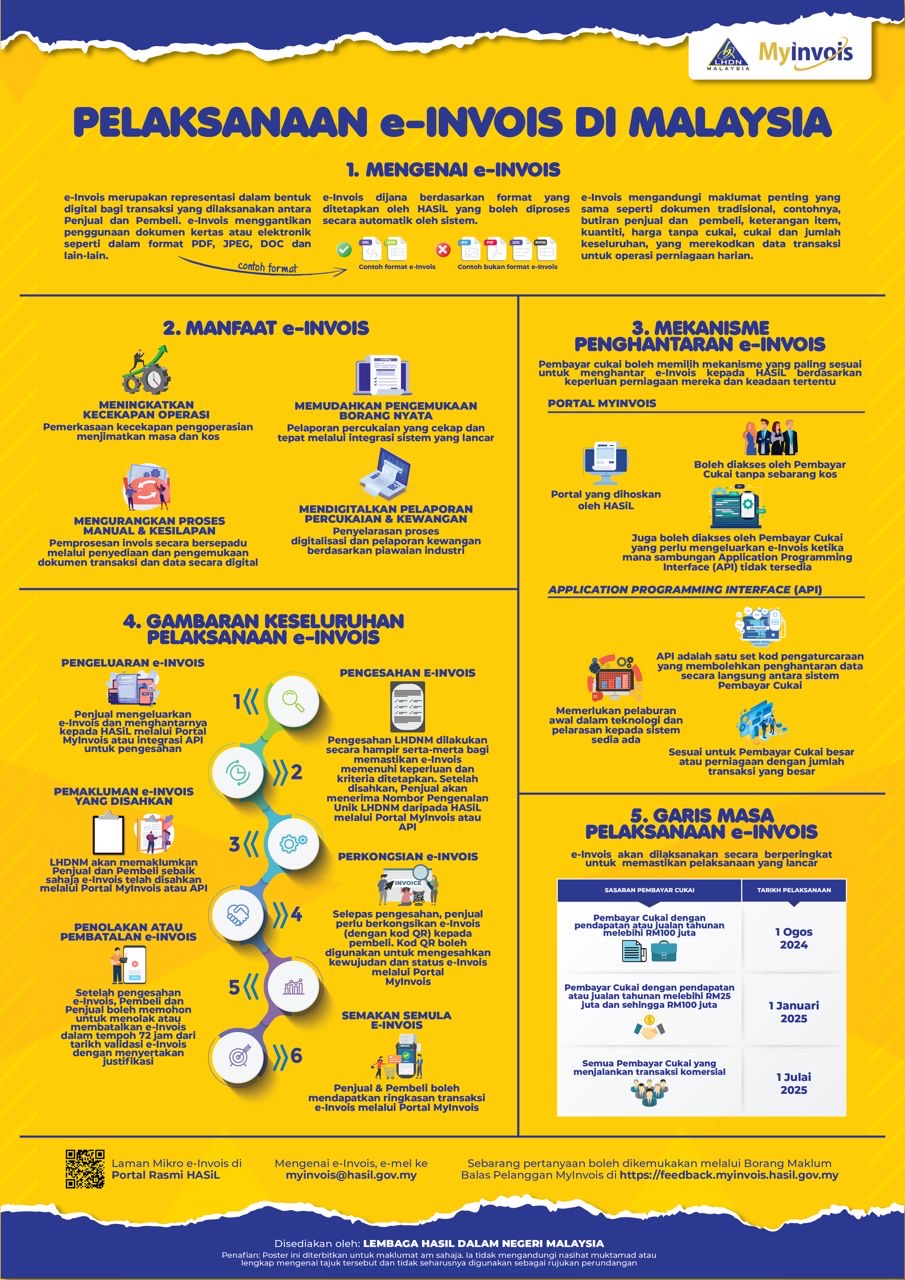

Introduction to e-Invoicing

e-Invoicing, or electronic invoicing, represents the digital format of invoices used for transactions between buyers and sellers. This system replaces traditional paper invoices with digital formats such as PDF, JPEG, DOC, and more. In Malaysia, e-Invoices follow a specific format set by the Inland Revenue Board of Malaysia (HASiL), allowing for automatic system processing. This digital transformation helps streamline transaction documentation and daily operational tasks.

Benefits of e-Invoicing

Implementing e-Invoicing in Malaysia offers numerous advantages, including:

- Enhancing Operational Efficiency: e-Invoicing improves the speed of processing transactions, saving time and reducing operational costs.

- Simplifying Tax Reporting: It facilitates accurate and efficient tax reporting through seamless integration with reporting systems.

- Reducing Manual Processes: Automation of invoice issuance minimizes the need for manual data entry and paperwork, leading to fewer errors and quicker transaction processing.

- Digitizing Financial and Tax Reporting: Transitioning to digital financial and tax reporting enhances accuracy and reliability, ensuring compliance with industry standards.

e-Invoicing Transmission Mechanism

Taxpayers can choose the most suitable method to send their e-Invoices to HASiL based on their business needs and current technology infrastructure. The two primary methods are:

- MyInvois Portal: A portal provided by HASiL that allows taxpayers to send e-Invoices at no cost.

- Application Programming Interface (API): APIs facilitate direct and real-time transmission of e-Invoices from taxpayers’ systems to HASiL, ideal for larger taxpayers or businesses with high transaction volumes.

Overall e-Invoicing Implementation Process

The implementation of e-Invoicing involves several key steps:

- Issuance of e-Invoices: Sellers issue e-Invoices in the format specified by HASiL through the MyInvois portal or API for verification.

- Verification of e-Invoices: HASiL verifies e-Invoices in near real-time, confirming the details and authenticity.

- Announcement of Verified e-Invoices: Once verified, HASiL will announce the verified e-Invoice via the MyInvois portal or API.

- Rejection or Cancellation of e-Invoices: If an e-Invoice is rejected or needs to be canceled, it will be updated accordingly, ensuring accurate records.

- e-Invoice Sharing: After verification, e-Invoices are shared with relevant parties, including buyers and relevant tax authorities, ensuring transparency and compliance.

- Rechecking e-Invoices: Both sellers and buyers can recheck the transaction details via the MyInvois portal to ensure accuracy.

Timeline for e-Invoicing Implementation

The implementation of e-Invoicing will be carried out in stages to ensure a smooth transition for all taxpayers:

- 1 August 2024: For taxpayers with annual sales exceeding RM100 million.

- 1 January 2025: For taxpayers with annual sales between RM50 million and RM100 million.

- 1 July 2025: For all other taxpayers.

Conclusion

The transition to e-Invoicing in Malaysia marks a significant step towards digital transformation in financial transactions. By adopting e-Invoicing, businesses can benefit from enhanced efficiency, reduced costs, and improved accuracy in tax reporting. As Malaysia moves forward with this implementation, it is crucial for businesses to stay informed and prepare for these changes to ensure seamless compliance and operational efficiency.